The Basic Principles Of Hard Money Atlanta

Wiki Article

The smart Trick of Hard Money Atlanta That Nobody is Discussing

Table of ContentsAll about Hard Money AtlantaHard Money Atlanta for DummiesHard Money Atlanta for BeginnersSome Known Details About Hard Money Atlanta

Since hard money loans are collateral based, also understood as asset-based car loans, they need very little documentation and allow financiers to enclose a matter of days. These lendings come with even more threat to the lender, and also therefore need greater down repayments as well as have greater interest prices than a standard car loan.Along with the above failure, hard money financings and also traditional home loans have various other distinctions that differentiate them in the minds of investors as well as lenders alike: Difficult cash fundings are funded much faster. Lots of conventional loans might take one to 2 months to shut, however hard cash finances can be enclosed a few days.

Conventional home loans, in contrast, have 15 or 30-year repayment terms on standard. Difficult cash fundings have high-interest prices. A lot of tough money lending interest rates are anywhere in between 9% to 15%, which is considerably greater than the interest rate you can anticipate for a standard home loan.

This will include getting an evaluation. You'll obtain a term sheet that lays out the financing terms you have actually been accepted for. Once the term sheet is authorized, the car loan will certainly be sent to handling. Throughout loan processing, the loan provider will certainly request documents and also prepare the financing for final loan evaluation and also timetable the closing.

Some Of Hard Money Atlanta

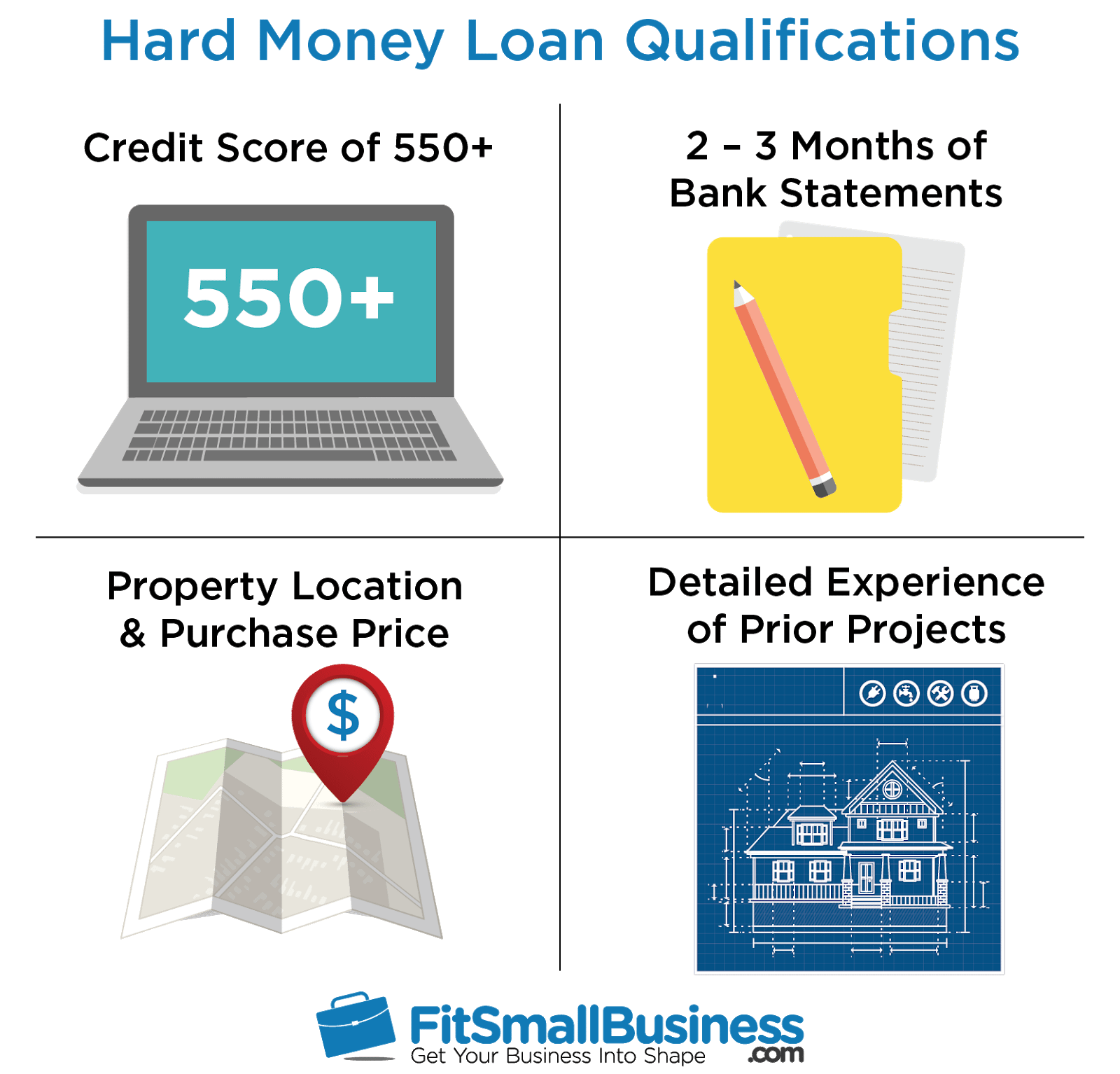

You'll require some resources upfront to qualify for a tough money car loan and the physical home to offer as collateral. In addition, tough money loans usually have higher passion prices than standard home loans. hard money atlanta.

Common leave techniques include: Refinancing Sale of the possession Payment from various other resource There are several scenarios where it may be beneficial to utilize a tough money finance. For beginners, investor who such as to house flip that is, acquire a rundown residence in requirement of a great deal of job, do the job personally or with contractors to make it extra beneficial, then reverse as well as sell it for a greater price than they purchased for might find hard money finances to be optimal financing alternatives.

Since of this, they do not require a lengthy term and also can avoid paying also much passion. If you purchase financial investment residential or commercial properties, such as rental properties, you may additionally locate hard cash fundings to be good options.

The 8-Minute Rule for Hard Money Atlanta

In some situations, you can also make use of a tough cash funding to buy uninhabited land. Keep in mind that, even in the above situations, the potential drawbacks of tough money lendings still apply.If the phrase "hard cash" influences you to start pricing estimate lines from your favorite gangster flick, we wouldn't be shocked. While these kinds of finances may seem difficult and challenging, they are a commonly used financing technique lots of genuine estate financiers make use of. What are hard cash fundings, and how do they work? We'll discuss all that and also much more right here.

Tough cash loans typically come with greater rate of interest rates and also much shorter repayment timetables. Why choose a tough money lending over a standard one?

Getting My Hard Money Atlanta To Work

Furthermore, because exclusive people or non-institutional loan providers offer tough cash car loans, they are exempt to the exact same laws as conventional Visit Your URL lending institutions, which make them more dangerous for borrowers. Whether a hard cash loan is best for you depends on check this your situation. Hard cash finances are good options if you were denied a traditional lending and also require non-traditional financing., we're below to help. Get started today!

The application procedure will normally include an evaluation of the residential or commercial property's worth as well as possibility. By doing this, if you can not afford your repayments, the tough money loan provider will merely move in advance with marketing the building to recover its financial investment. Difficult money lenders commonly charge higher rate of interest rates than you would certainly carry a standard finance, yet they also fund their fundings more promptly and generally call for less documents.

Rather than having 15 to three decades to repay the car loan, you'll usually have just one to 5 years. Difficult money lendings work rather in a different way than traditional loans so navigate to these guys it's crucial to recognize their terms and also what purchases they can be used for. Hard money financings are normally planned for investment residential properties.

Report this wiki page